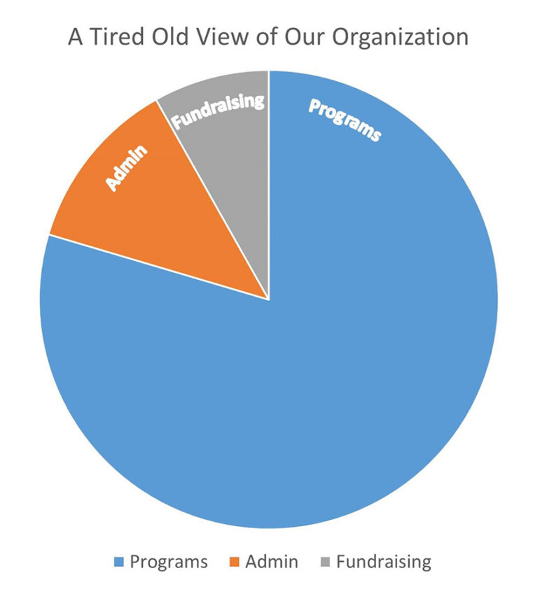

It’s time to retire this pie chart

Most nonprofit leaders agree that we need a new way to communicate about the true costs of our programs and the vital importance of strong organizational infrastructure. But we have not yet developed a simple, consistent message when sharing our view with potential supporters and investors.

When nonprofits are viewed this way, no matter how hard we try, we imagine important infrastructure of our organization as taking a slice out of the pie—as diminishing the “real” work of our mission. Strategic financial functions, good governance, and key funding partnerships are vital to strong organizations.

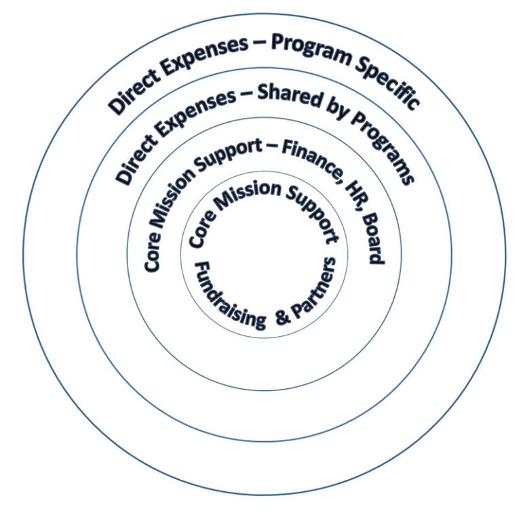

We need a new image

Investment in key infrastructure does not diminish our programs, it is valuable Core Mission Support.

Core Mission Support functions are necessary, vital, and integral.

- Strong, strategic finance and accounting

- Progressive human resources practices

- Capable, responsive board governance

- Talented and engaged development staff

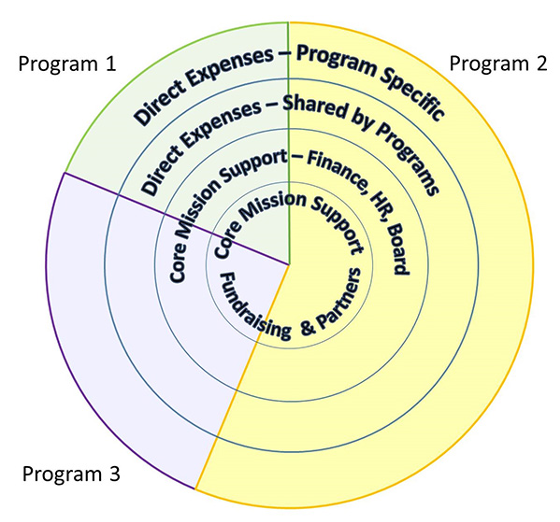

Whole organizations and True Program Costs

Our programs are built around, supported by, and share responsibility for Core Mission Support.

All of the resources we need to accomplish our programs are the True Program Costs, which include:

- Direct Expenses: Program-Specific

- Direct Expenses: Shared by Programs

- Core Mission Support: Finance, HR, and Board

- Core Mission Support: Fundraising & Partners

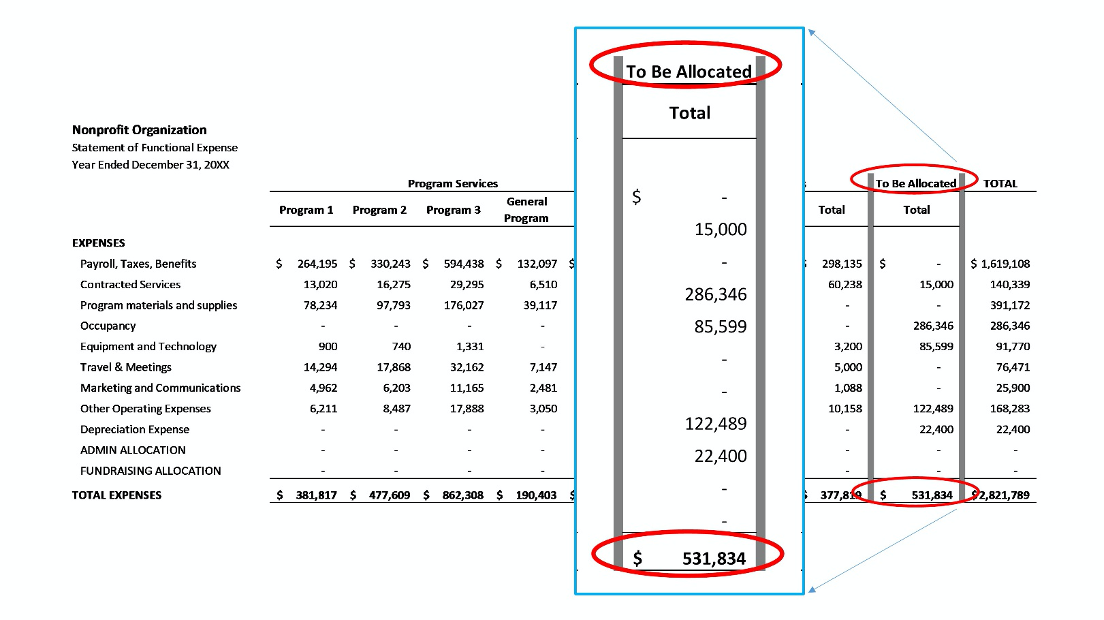

Elegant allocations on the way to True Program Costs

For nonprofits, we strengthen our decision making when we can see the whole truth about our programs and their finances. For a complete view of the financial state of any one program, we need to see the full range of resources required to support it. We do that by allocating costs.

The difference between shared direct costs and administrative costs

Nonprofits sometimes misunderstand the difference between shared direct costs and administrative costs. Just because a resource is used by more than one program or functional area (administration or fundraising) does not define it as an administrative cost.

A high-level definition of administrative costs (aka, management and general; aka, indirect) is that they are resources used for the overall management of the entire organization. These are often expenses related to board governance, financial accounting, human resources, and organization-wide staff meetings.

Shared direct costs (aka, shared program costs; aka, allocable direct costs) are resources that each program uses to accomplish its mission work. Nonprofits most often acquire these resources centrally and make them available to each program as well as the administrative and fundraising functions. It is generally not possible (or would be prohibitively expensive and time-consuming) to track the exact amount used by each program or function. These are often expenses like office supplies, occupancy, technology, and equipment.

A two-step approach to allocating nonprofit expenses

To allocate costs properly, we take a two-step approach. The first step is to allocate shared direct costs. The second step is to allocate the expenses aggregated in the administrative and fundraising categories.

To organize shared direct expenses best, we create a “To be allocated” or “Allocable expenses” cost center. This allocation cost center sits parallel to the other functional cost centers (programs, administration, and fundraising) in our structure. When incurring expenses and coding them into our accounting system, we choose this cost code. This step organizes all of our shared direct costs into one easily identifiable category.

Getting to true program costs

Once we have allocated all of the shared direct costs, we move to the next step – allocating management and general costs and fundraising costs to programs. This step is crucial in giving us the full picture of what resources we need to fulfill our mission goals successfully in each program area.

Unlike shared direct costs, we do not need to allocate management and general costs or fundraising costs by line item. We can allocate these costs in aggregate, by using elegant chart of accounts line items created especially for this task. We often call these line items “Administrative Allocation” or “Fundraising Allocation.” The name is optional, though it should communicate how the line items are used.

Using true program costs to elevate financial decisions

Doing the extra work of allocating expenses across programs is in service of heightened decision-making processes. Knowing what each of our programs really costs gives us a better chance of raising money to cover the full costs. Knowing true program costs allows us to compare more accurately the mission impact of each of our program areas. When choosing where to invest our resources, using elegant allocations gives us a more sophisticated understanding of what outcomes we are achieving and at what cost.

This material is drawn from a number of blogs and articles previously published by Curtis Klotz. Curt will be presenting a half-day workshop, “Core Mission Support, Elegant Allocations, & Full-Cost Accounting,” on Wednesday, March 25th

“A Graphic Re-Visioning of Nonprofit Overhead,” Nonprofit Quarterly, August 2016

https://nonprofitquarterly.org/graphic-re-visioning-nonprofit-overhead/

“Elegant Allocations in Nonprofit Accounting,” CLA Innovation in Nonprofit Finance blog, September 2019

https://blogs.claconnect.com/nonprofitinnovation/elegant-allocations-in-nonprofit-accounting/

“Shaping Your Ask: How Nonprofits Can Learn to Love Restricted Revenue,” CLAconnect.com, May 2019

https://www.claconnect.com/resources/articles/2019/shaping-your-ask-how-nonprofits-can-learn-to-love-restricted-revenue

“What’s the Right Price for Nonprofit Mission?” CLA Innovation in Nonprofit Finance blog, January 2020

https://blogs.claconnect.com/nonprofitinnovation/whats-the-right-price-for-nonprofit-mission/

About Curtis Klotz, CPA

Curtis Klotz, CPA, serves as Director of Nonprofit Innovation at CLA. This role is grounded in CLA’s nonprofit consulting and business operations practice, which inspires Curt’s writing and thought leadership. Curt shares inventive strategies for nonprofits that have emerged from more than 35 years of direct work in nonprofit organizations, including his former role as VP of Finance & CFO at Propel Nonprofits. Along with other stints as a nonprofit CFO, he is also past Chairperson of the Montana Nonprofit Association. Curt has contributed a number of articles to Nonprofit Quarterly and is the principal author of CLA’s Innovation in Nonprofit Finance blog. Curt was honored as MSP Biz Journal’s Nonprofit CFO of the Year in 2017. To fully appreciate Curt’s approach to nonprofit finance, you should know that he graduated summa cum laude from St Olaf College with majors in women’s studies and religion.