Have you ever taken advantage of a buy-one-get-one-free deal? You get to enjoy two new products for the price of one! In the nonprofit world, corporate matching gifts are the closest thing you can get to experiencing this scenario.

In a nutshell, corporate matching gifts are donations that companies make to a nonprofit to match an employee’s donation. This means that your fundraising efforts can reap double the financial reward. However, many donors don’t take advantage of matching gifts simply because they aren’t aware that their employer offers them.

According to recent statistics, an estimated $4-$7 billion in matching gift revenue goes unclaimed every year. To help you bridge this awareness gap and maximize your matching gift revenue, this guide will review the top do’s and don’ts.

Do: Conduct thorough research

Begin your matching gift journey by building a strong foundation of knowledge to pull from. Then, you’ll be ready to confidently launch your program and standardize your approach. Your nonprofit should be familiar with the following matching gift terms and concepts:

- Employee eligibility. Not every employee is eligible to submit a matching gift request. Do your research to determine if your donors fall under any restrictions based on the duration of their employment, role, or employment status.

- Match ratio. This refers to the ratio at which a company is willing to “match” their employees’ contributions. For instance, some companies will match at a 1:1 ratio, so that a $50 donation receives a $50 match and becomes a $100 total donation. Other companies might match as much as $4 for every $1 an employee donates, which equates to a 4:1 ratio.

- Minimum and maximum amounts. The minimum amount is the smallest amount of money a company is willing to match (for most it’s $25). Maximum amounts refer to the largest amount of money a company is willing to match, which can range from $1,000 to $15,000. Both of these metrics vary per company.

- Submission deadlines. Each company sets different deadlines, and if you keep your donors informed, you’ll ensure they won’t miss their window to submit a request. Common deadlines are the end of the calendar year or a set number of months following the initial donation.

With these details in mind, you can build your matching gift program knowledge and apply it to your own donor base. For example, you might research top matching gift companies and see if any of your donors are currently employed there. Then, you can begin to spread the word and reel in more donations.

Don’t: Forget to promote your matching gift program

Mention matching gifts wherever you can to spread the word. Most commonly, nonprofits use their donation pages and confirmation screens to add a matching gift reminder in addition to other forms of outreach such as email or direct mail campaigns.

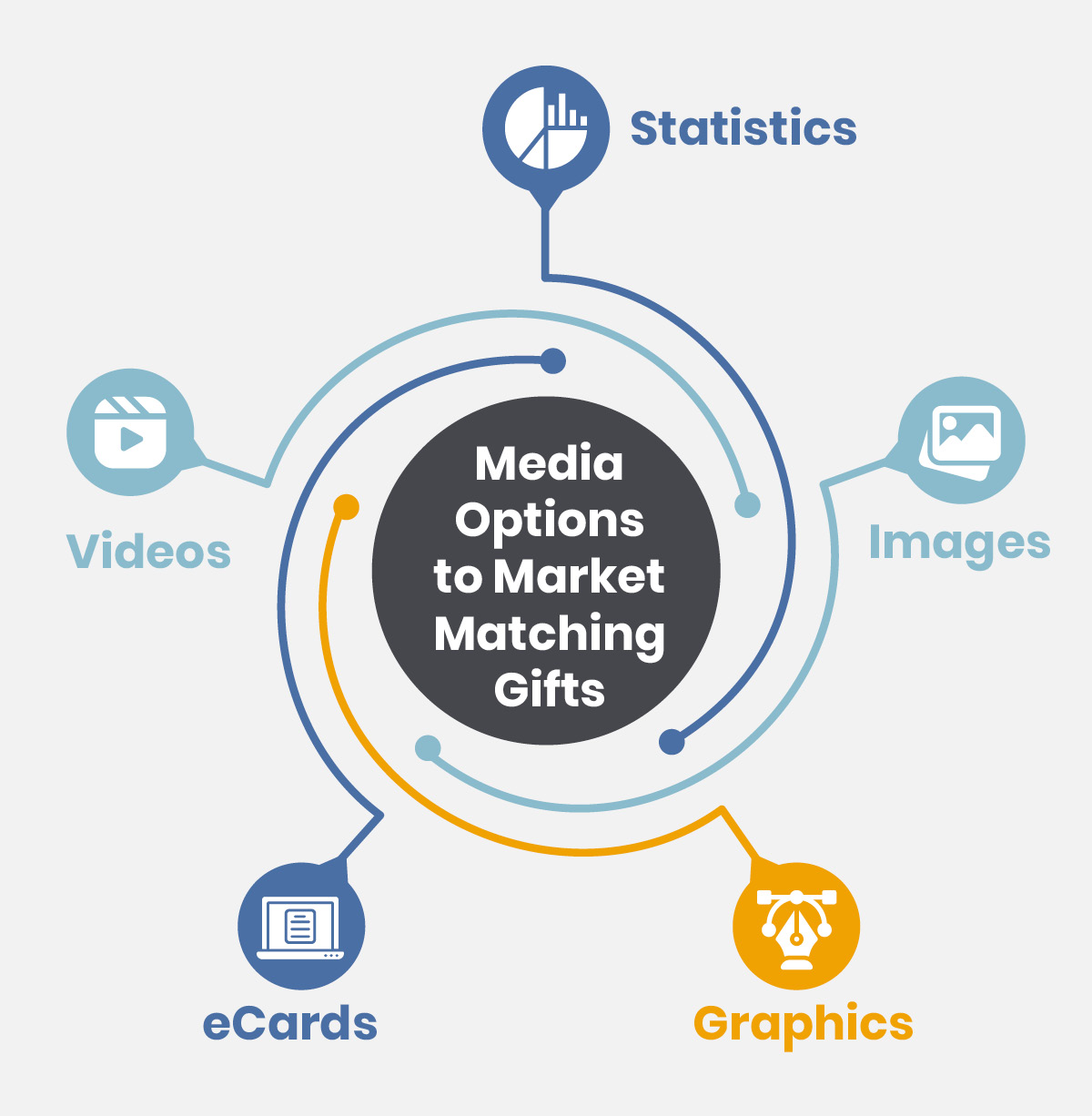

When planning your promotion, vary your communication and content to make your marketing appeals stand out. Use a mix of media options to keep your message informative and engaging. These could include:

- Statistics. Highlight key statistics related to your matching gift program, such as how much matching gift revenue you’ve raised or how many donors take part every year.

- Videos. Share short explainer videos that give a quick overview of how the matching gift process works and how matching gift revenue positively impacts your nonprofit.

- Images. Post photos of your staff and volunteers fulfilling your mission to directly associate increased matching gift funding and social good.

- Graphics. Use visually appealing infographics to explain matching gifts, and add a call to action for donors to submit their requests.

- eCards. Send branded thank you eCards or hand-written letters to donors. Thank them for their initial contribution, and inform them how they can get their gift doubled or tripled.

For more inspiration, consider researching successful matching gift campaigns. For example, you might find that a nonprofit with a similar donor base has found success by incorporating FAQs in their dedicated matching gift page.

Do: Clearly feature accessible information

To ensure everyone can easily digest your content, accessibility is a must when it comes to explaining the matching gift process. You’ll need to use clear and concise language so your donors can understand without having to do extra digging. Here are a few ways you can clarify matching gifts:

- List the typical steps involved in the process on your online matching gift explainer page.

- Embed a matching gift plugin that can help your donor search for their company’s program.

- List companies you commonly match with, so donors can double-check their eligibility.

- Mail out informational materials explaining corporate philanthropy and the impact of matching gifts.

Matching gifts can be a new concept for many donors. Walk through the process with them, and anticipate their questions by providing comprehensive online resources for them to learn more.

Additionally, you can make matching gifts more accessible by staying on top of new technology trends that make the process more straightforward. For example, Double the Donation’s auto-submission tool cuts the steps in half, so donors only need to input their corporate email address to submit a matching request.

Don’t: Let employer details slip through the cracks

When appropriate, collect employer data. That way, your staff can follow up to get donors’ initial gifts matched.

You can do this by keeping records of individuals’ matching gift statuses within a secure and reliable database. Specifically, you’ll want to know what requests have been made, when they were processed, and when they were filled. This way, you’ll have a clear map of what has happened and needs to happen to alleviate communication mishaps and increase donations.

Maintain your donor database by cleaning out any outdated or duplicated information. Then, fill in gaps by reaching out to donors to fill out any missing information. Make sure that those who need this information can easily find it within your existing systems.

Do: Cultivate corporate relationships

You’ll want to show gratitude to both your donors and their employers for their matching gifts. Plan to communicate your appreciation after you receive the first gift and a second time after the company has submitted their match.

You can also plan an appreciation event or thank donors publicly on social media. This way, you’ll communicate your gratitude and raise awareness for matching gifts at the same time.

Take advantage of the introduction a matching gift request has provided your nonprofit with by cultivating corporate relationships as well. Let them know how their corporate philanthropy has positively impacted your mission. And, if they’ve matched several donations over the years, thank them for their continued support.

Navigating corporate matching gifts can be daunting, especially for new nonprofits. But, with guides like this one and other online resources, you will quickly be on your way to doubling or even tripling your revenue!